[ad_1]

Posted on: July 24, 2023, 01:32h.

Last updated on: July 24, 2023, 01:45h.

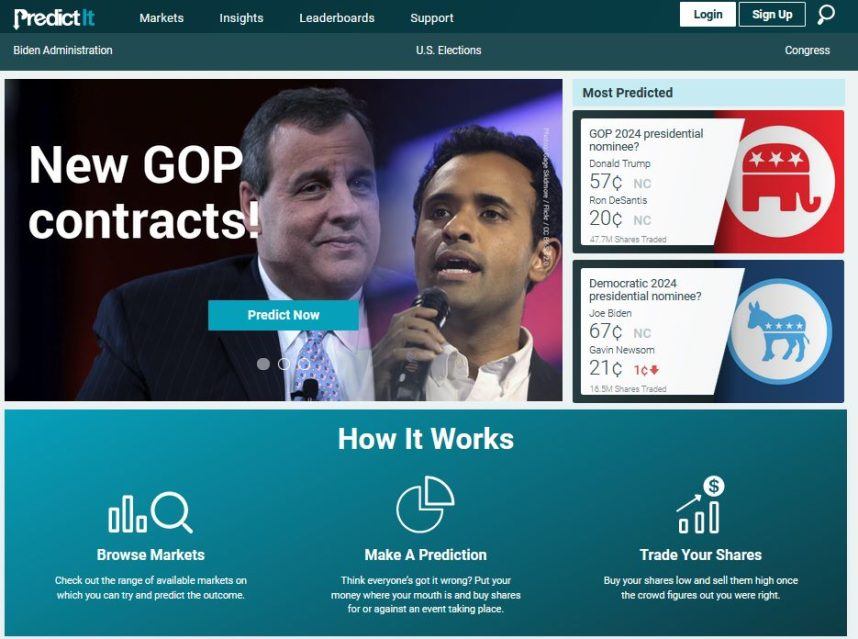

A federal court is allowing PredictIt to keep its political futures markets online while it pursues litigation against a federal agency trying to shut the site down.

The US Fifth Circuit Court of Appeals panel Friday ruled that the PredictIt and its users were ultimately likely to prevail in their lawsuit against the Commodity Futures Trading Commission. In a 2-1 decision, the judges ordered a lower court to prevent the CFTC from taking any further action against PredictIt until it decides the merits of the case.

“This is a sweeping victory for prediction markets like PredictIt and those who find value in the insights they provide,” PredictIt co-founder and CEO, John Phillips said in a statement. “One of the highest courts in the country agrees that in 2014 PredictIt was issued a license to operate, and the CFTC’s attempts to take that away were unjustified.”

Great news from the Fifth Circuit today! https://t.co/deEMt7HVn9 pic.twitter.com/RzMs5lKnbz

— PI (@PredictIt) July 22, 2023

District Court to Decide

The case now goes back to the United States District Court for the Western District of Texas for a trial on the merits. The case was brought by PredictIt and a group of users who argued that the CFTC violated due process requirements when it withdrew prior assurances that PredictIt would not be subject to enforcement action.

We now conclude that a preliminary injunction was warranted because the CFTC’s rescission of the no-action letter was likely arbitrary and capricious,” Fifth Circuit Judge Stuart Kyle Duncan wrote in the majority opinion issued Friday.

The ruling is the latest milestone in a years-long fight over whether PredictIt can continue to operate without registering with the CFTC. The site was launched at Victoria University in Wellington, New Zealand, and allows users to wager on the outcome of elections and other political events.

‘No-Action’ Letter

When PredictIt was launched in 2014, Victoria University sought and received from the CFTC a “no-action letter,” which absolved it from having to register as a regulated marketplace under the Commodity Exchange Act. The university said the political betting markets would produce valuable data for academic research and that it would limit the size of its markets to 5,000 participants and cap bets at $850.

Eight years after agreeing to spare PredictIt from oversight, the CFTC abruptly reversed course in August 2022, rescinding the 2014 “no-action letter” and ordering it to liquidate its operations within six months.

In response, PredictIt and a group of site users sued the CFTC, and they were previously able to win a reprieve from the CFTC’s efforts to shutter the site by February.

Parties ‘Continue to Spar’

Following that ruling and oral arguments in the underlying case, the CFTC changed course in March and sought to end the litigation by replacing its August 2022 action with a new “preliminary” decision on the no-action letter. The CFTC’s Division of Market Oversight maintained the view that the earlier no-action letter was invalid, but it said PredictIt had an opportunity to argue its case.

Duncan rejected the CFTC’s argument that its March letter made the case moot.

“The parties continue to spar over whether PredictIt can operate outside the CEA’s strictures … The fact that Victoria University can try to change the DMO’s mind does not change the fact that the DMO has declared the no-action letter ‘void,’” the judge wrote in his opinion.

[ad_2]

Source link